Overview: Closing periods is optional within Xactly, and depending on the way your company is processing commissions, you may or may not need to finalize (close) periods. Below are some reasons why you would need to finalize periods:

- Draw Payments (when using Plan Design -> Draws) occur only after period is finalized. Since “Recoverable/Non-Recoverable Guarantee” type draws are paid net of commissions earned, finalizing the period ensures there will be no further commissions processed.

- Draw Balance Recovery occur only after period is finalized. Period needs to be finalized to ensure no additional commissions are generated and the recovery is complete (similar to above).

- Balance Carry Forward (BCF) recovery occurs only after period is finalized. BCF is different from Draw Balances since balance owed is a result of a negative commission such as de-book/clawback

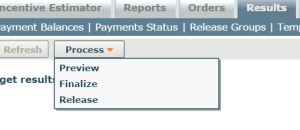

To finalize a period, navigate to Results -> Payments, click on the “Process” drop down -> Finalize -> Drag over Business groups which you would like to to finalize

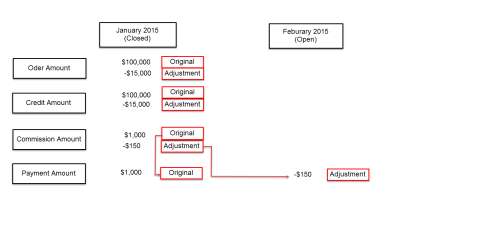

Prior Period Adjustments: Unless periods are finalized processing prior period adjustments may be difficult since often the transaction adjusted occurred in a prior period but is paid in the current period. If periods are finalized you can upload your adjustment into a prior period (closed), calculate the adjustment and have the resulting payment push into the first (current) open period since credit/commission are tied to the period in which you are processing and the resulting payment is always pushed into the first open period.

For example, Jan 2015 has been finalized, however after some additional review a $100,000 order, previously assigned to person A in January, later turned out to be $85,000. Person A has been overpaid and we need to recover. As Best Practice I would suggest uploading and calculating a -$15,000 order (same order code if possible) to person A in January. Credit and Commission for this order would net to $85,000 (where truly earned), however the resulting negative payment will push into the first open period (Feb). This way amount person A got paid in January would still be accurate and match to payroll. If we look at the same example without closing periods, processing the -$15,000 would adjust credit, commission and payment all in January. Although this might seem easier, the January payment amount would no longer match to payroll, which would create potential problems with an Audit, as well as the employee.

Alternatively to Xactly, would also recommend another ICM system – http://www.zencentiv.com